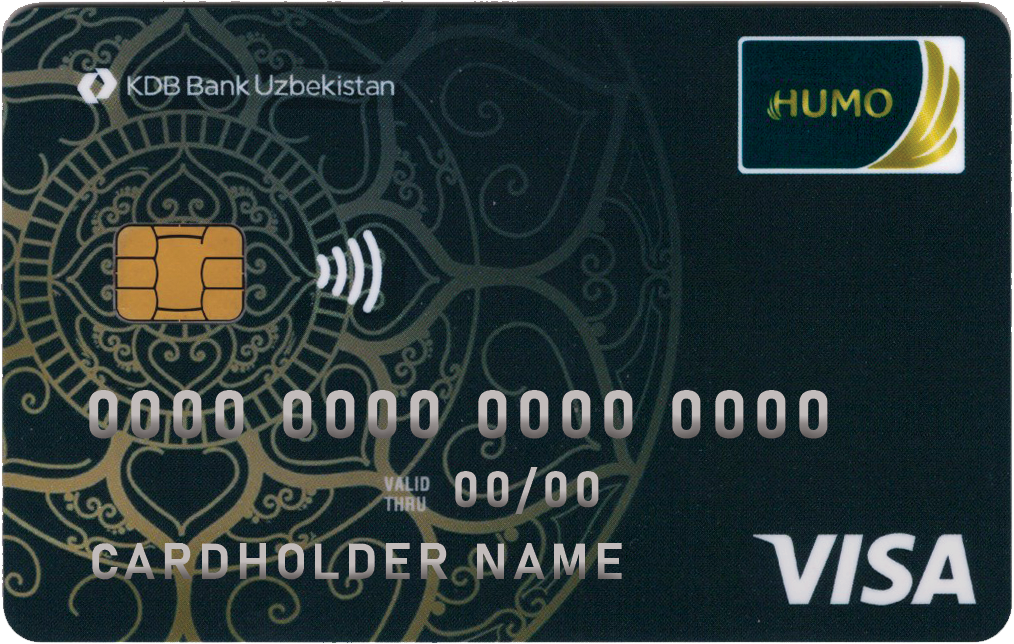

Payment system:

Currency:

Type of card:

HUMO

Contactless cards do not need to be handed to a cashier in a store or to a waiter in a restaurant. Thus, fewer outsiders will be able to spy on the card data.

Another plus is the increased card life since it is less exposed to mechanical stress - it does not need to be taken out of the wallet, inserted into the payment device.

Please see the following transit accounts for other transfers.

23120000600000842001- UzCard MFO: 00842 Tax number: 202167236

23120000900000842200 - HUMO MFO: 00842 Tax number: 202167236

Also in details on transfers must be mentioned a full number of card and name and surname of the receiver.

To open a card in KDB Bank Uzbekistan following actions are needed to be done:

Terms of use bank cards HUMO and UZCARD

1. A bank card is intended for payment for goods, works or services in trade and service sphere, for cash withdrawal from ATMs and cash desks of banks and for the performance of other operations stipulated by the Terms of the payment system and the Legislation of the Republic of Uzbekistan.

2. The Special Card Account (SCA), opened by the Bank, is used to record transactions using the Bank Card and is not related to business activities or private practice established by the legislation of the Republic of Uzbekistan.

3. The Holder has the right to address in the Bank with the Application for registration of the Additional card on behalf of another person. The Additional Cardholder has the right to perform operations specified in Clause 1 of these Rules but has no right to dispose of the SCA.

4. The bank card is the property of the Bank. Upon expiry of the validity period of the Card indicated on the front side of the Card, the Client shall submit the Card to the Bank for subsequent re-issue of the Card or closing upon the Client's Application.

5. The Cardholder shall not transfer the Card and disclose his/her PIN to third parties. The Holder should keep the Card in a safe place, excluding damage and unauthorized use by third parties, keep the PIN-code in secret; do not write it down on the card or other paper carrier, stored together with the card.

6. The Client bears all risks and material responsibility for transactions made with the Bank's card until the Bank receives the notification of card loss.

7. Upon discovery of a card previously declared as lost, the Client shall immediately inform the Bank and return the card.

8. The Client must retain all documents related to Bank Card transactions and submit them upon request of the Bank to substantiate the legality of receipt and spending of funds. These documents may also be useful in the resolution of various issues with other control authorities; for example, a cheque may serve as evidence of the legality of receipt of funds and their expenditure.

9. In case of acquisition of goods and services, and also the reception of cash resources with the use of the Bank card, the Holder of a card instructs the Bank to write off the corresponding sums from SCA in a non-acceptance order.

10. When using the card in trade or service companies, the Client is obliged to observe the following rules:

11. When using the Card at an ATM, the Client must comply with the following rules:

12. For the security purposes of Card transactions, the Client may set the following Card transaction limits on the Application:

13. It is recommended that the Client activates the SMS notification service to control the balance of the Bank Card and to record each SCA transaction.

14. The Client bears all risks and material responsibility for transactions made with the Bank Card details: via Internet shops, mobile payment systems, and services; if the Bank Card details became available to third parties as a result of careless handling or loss of mobile devices.

15. In case of early cancellation of the Bank Card and closure of the SCA, the Client must return to the Bank all received Cards, including issued additional Cards.

16. The Bank shall not be liable for situations beyond its control and related to failures in the operation of external devices, settlement systems, data processing, and transmission.

17. The Bank shall not be liable if the Card has not been accepted for payment by a third party.

18. The Bank is not responsible if restrictions of other banks, as well as limits on the amount of cash withdrawal from ATMs set by them, may affect to some extent the interests of the Client.

19. The Bank does not refund in cash the value of the goods purchased by the Cardholder and then returned to the seller. The refund can be made only by cashless transfer of funds to the Card Account by the seller of the goods.

20. The Bank is entitled to change the Tariffs and Regulations.

22. The Holder unconditionally compensates the Bank for the damage caused by the default of the present Terms.

23. Return of balance from the Client's SCA is performed in case of absence of debts of the Client to the Bank on transactions and/or commissions, in terms, established by legislation.

1 | Plastic card issuance | 0.1 BEV |

2 | Plastic card issuance under salary (social) project | Free of charge |

3 | Plastic card issuance (additional card) | 0.1 BEV |

4 | Card reissuance due to damage or loss | 0.1 BEV |

5 | Card re-issuance due to expiry | Free of charge |

6 | Un-blocking of the card | Free of charge |

7 | Including of the card into Stop list (Card blocking) | Free of charge |

8 | Card account maintenance (servicing) fee | Free of charge |

9 | Payment for goods and services in UZS | 0% of the amount |

10 | Payment for goods and services in foreign currency | 0.5% of the amount (min. 5,000 UZS) |

11 | Cash withdrawal through the Bank's cash office | Free of charge |

12 | Cash withdrawal through the Bank's ATMs | 1% of the amount |

13 | Cash withdrawal in foreign currency | 1.5% of the amount (min. 30,000 UZS) |

14 | Cash deposit through the Bank's cash office | Free of charge |

| 15 | Cash deposit through the Bank's ATMs | Free of charge |